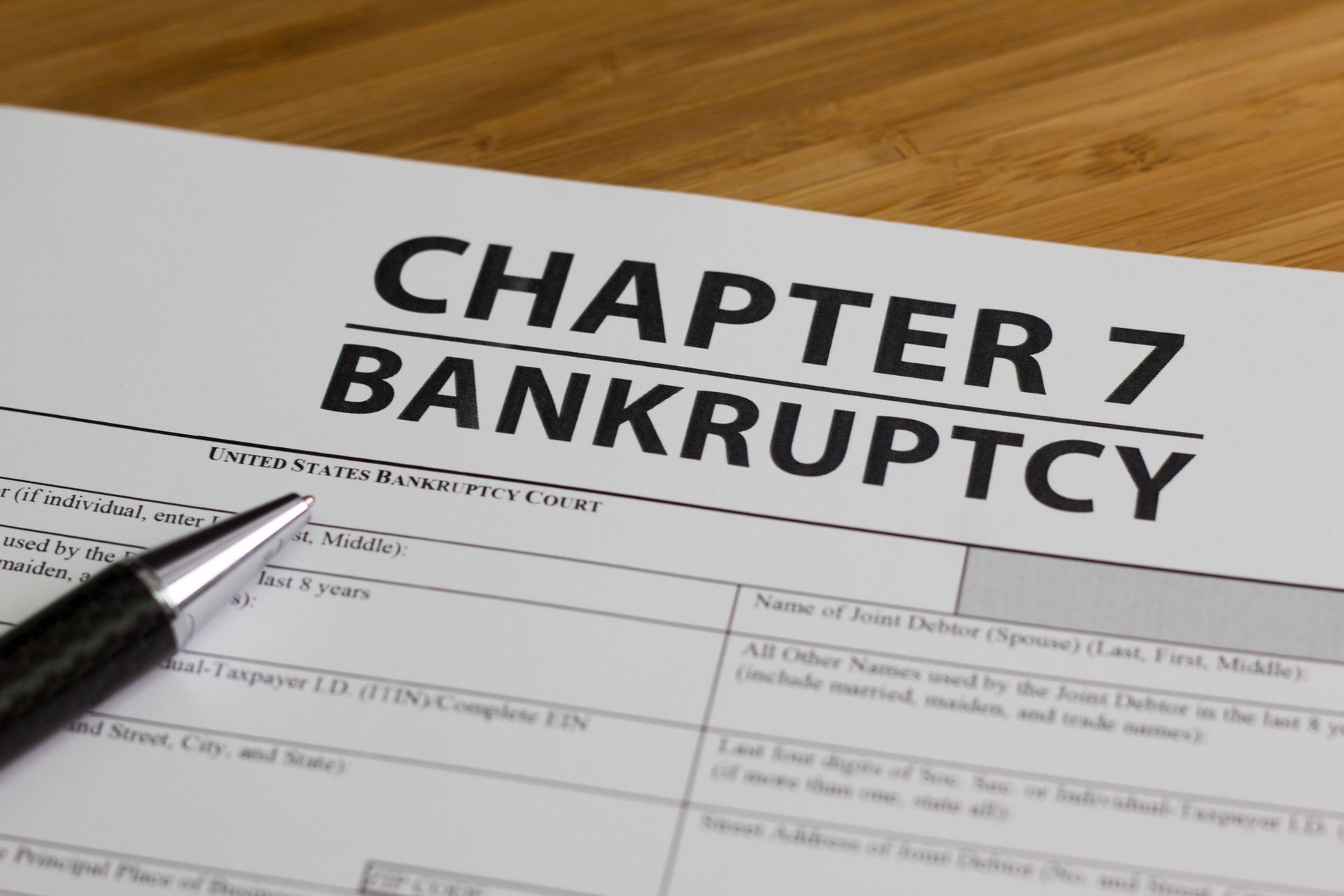

Finding the right bankruptcy attorney is crucial to getting your financial situation back on track. At McManus and Associates, we understand how overwhelming this process can be. As a trusted Chapter 7 bankruptcy attorney in Indianapolis, IN, we are here to guide you through every step. Here’s what you should consider when choosing the best attorney for your needs.

The first step in selecting a Chapter 7 bankruptcy attorney in Indianapolis, IN, is to evaluate their experience and specialization. Not all lawyers have specific expertise in bankruptcy law.

Effective communication is vital in legal matters. Your attorney should be approachable, responsive, and clear in their explanations.

A good Chapter 7 bankruptcy attorney in Indianapolis, IN, will have a proficient support team. This includes paralegals and administrative staff who help ensure that your case progresses smoothly.

Cost is a crucial factor when hiring a bankruptcy attorney. Understanding their fee structure can help you make an informed decision.

Most bankruptcy attorneys, including McManus and Associates, offer a free initial consultation. This meeting is your opportunity to ask questions and assess if they are a good fit for your needs.

Personal recommendations and online reviews are invaluable when selecting a Chapter 7 bankruptcy attorney.

McManus and Associates have numerous positive reviews that highlight our commitment and success as a Chapter 7 bankruptcy attorney in Indianapolis, IN.

Choosing the right attorney to guide you through Chapter 7 bankruptcy is a critical decision that can impact your financial future. Focus on an attorney’s experience, communication, support team, fees, and recommendations to make an informed choice. Are you ready to take the next step towards financial freedom?

Schedule your free legal consultation with McManus and Associates,

your dedicated Chapter 7 bankruptcy attorney in Indianapolis, IN. Contact us today to get the professional help you deserve.

BROWSE OUR WEBSITE

CONTACT INFORMATION

OUR LOCATION

CONTACT INFORMATION

Phone: 317-841-0315

Fax: 317-841-0758

Email: jtmlaw@hotmail.com

Address:

3077 E. 98th Street

Suite 270

Carmel, IN 46280

OUR LOCATION